The rental application process in New Jersey involves submitting detailed forms‚ with recent legislation targeting algorithmic rent-setting software and expanded assistance programs for low-income tenants.

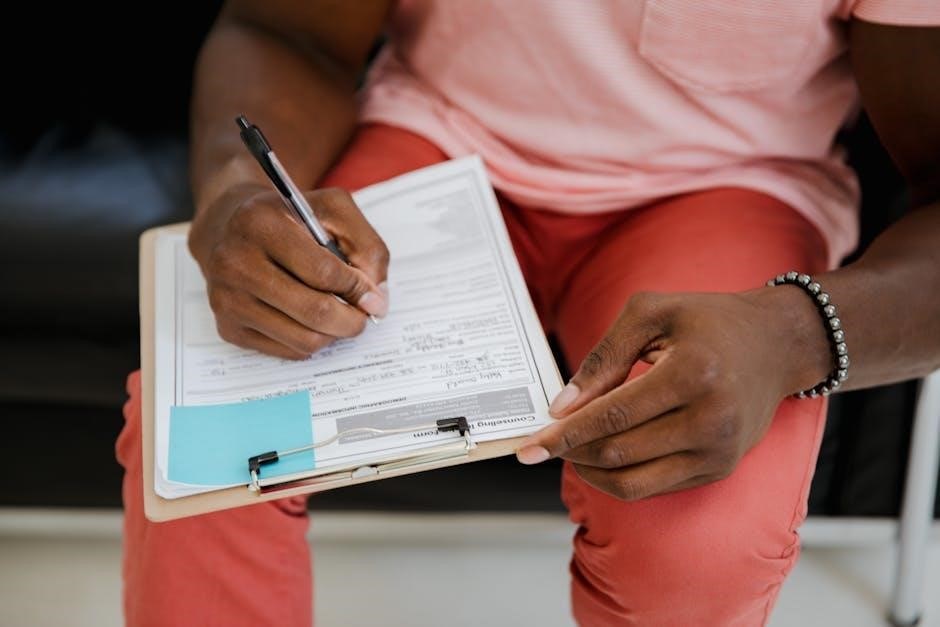

Overview of the Rental Application Form

The rental application form in New Jersey typically requires detailed personal‚ financial‚ and rental history information. Applicants must provide identification‚ employment details‚ and income verification. Landlords may also request credit reports and background checks. Recent legislative developments aim to regulate the use of algorithmic rent-setting software‚ ensuring fairness in pricing. Additionally‚ the state has expanded rental assistance programs‚ offering subsidies to low-income households. The form often includes sections for co-signers or guarantors if needed. Once submitted‚ landlords review the application‚ with processing times varying by property. The form is a critical step in securing housing‚ reflecting New Jersey’s efforts to balance tenant protections with landlord requirements.

Importance of Understanding the Application Process

Understanding the rental application process in New Jersey is crucial for tenants to navigate the competitive housing market effectively. Recent legislative changes‚ such as the proposed ban on algorithmic rent-setting software‚ highlight the need for transparency and fairness in rental practices. Tenants must be aware of their rights and the information required to complete applications accurately. This knowledge helps avoid delays or rejections and ensures compliance with state laws. Additionally‚ understanding the process empowers tenants to advocate for themselves‚ especially in cases of potential discrimination or unfair practices. Staying informed about rental assistance programs and lottery systems can also provide alternative pathways to securing housing in New Jersey’s challenging market.

Legal Requirements for Rental Applications in New Jersey

New Jersey requires landlords to avoid discriminatory practices and ensure transparency in rental applications‚ with recent lawsuits targeting illegal rent-setting algorithms and unfair tenant screening processes.

Landlord-Tenant Laws in New Jersey

New Jersey’s landlord-tenant laws emphasize fair housing practices‚ prohibiting discrimination based on race‚ religion‚ or disability. Recent legislation targets algorithmic rent-setting software‚ aiming to prevent unfair pricing practices that disadvantage tenants. The state also enforces strict rules on security deposits‚ requiring itemized deductions and timely returns. Tenants are protected against unlawful evictions‚ ensuring due process. Additionally‚ New Jersey’s eviction prevention programs and rental assistance initiatives reflect a growing focus on housing affordability‚ particularly for low-income households. These laws are continuously evolving‚ with ongoing efforts to balance landlord rights while safeguarding tenant interests in an increasingly competitive rental market.

Required Information on the Rental Application Form

A rental application form in New Jersey typically requires personal and financial details‚ including full name‚ Social Security number‚ employment history‚ and income verification. Rental history‚ with previous landlords’ contact information‚ is also mandatory. Applicants must disclose their credit score and authorize background checks. Additionally‚ proof of income‚ such as pay stubs or tax returns‚ is often requested. Some landlords may ask for references or a co-signer‚ especially for applicants with lower credit scores. Recent legislative developments‚ such as the proposed ban on algorithmic rent-setting software‚ aim to ensure transparency and fairness in the application process. These requirements help landlords assess eligibility while complying with state housing laws.

Prohibited Discrimination in Rental Applications

New Jersey law prohibits landlords from discriminating against applicants based on race‚ color‚ religion‚ sex‚ national origin‚ disability‚ familial status‚ or source of income. The state enforces strict fair housing laws‚ ensuring equal access to rental opportunities. Landlords cannot use rental application forms to gather information that could lead to discriminatory practices. Recent legal actions‚ including lawsuits against major landlords and property management companies like RealPage Inc.‚ highlight the state’s commitment to combating discrimination. Algorithms used in rent-setting software are also under scrutiny for potential bias. Tenants who experience discrimination can file complaints with state housing agencies‚ seeking legal recourse and compensation. These protections aim to create a fair and transparent rental application process for all applicants.

Recent Legislative Developments

New Jersey legislators are advancing bills to ban landlords from using algorithmic rent-setting software‚ aiming to promote fairness and transparency in rental pricing and applications.

New Jersey’s Stance on Algorithmic Rent-Setting Software

New Jersey is at the forefront of regulating rental practices‚ with proposed legislation aiming to ban landlords from using algorithmic software to set rents‚ ensuring fair competition and transparency in pricing‚ while also addressing concerns about potential discrimination and unfair rental practices through enhanced oversight and legal frameworks.

Proposed Bills and Their Impact on Rental Applications

New Jersey legislators are advancing bills to regulate rental practices‚ notably targeting the use of algorithmic software to set rents‚ aiming to enhance transparency and fairness in pricing. These proposed laws could significantly impact rental applications by potentially reducing discrimination and ensuring more equitable access to housing. Additionally‚ the state’s recent lawsuit against major landlords and RealPage Inc. highlights efforts to address alleged rent-setting collusion‚ further influencing how rental applications are processed and approved in the future.

Security Deposits and Rental Applications

New Jersey’s security deposit laws require landlords to disclose terms and conditions‚ ensuring transparency during the rental application process and protecting tenants’ financial interests effectively.

Security Deposit Laws in New Jersey

New Jersey security deposit laws regulate the amount landlords can charge‚ typically up to one and a half months’ rent. Landlords must store deposits in a separate bank account and return them within 30 days after the lease ends. Tenants are entitled to an itemized list of deductions if the deposit is used for damages or unpaid rent. Legal action can be taken against landlords who fail to comply with these regulations‚ ensuring tenants’ financial protections; These laws are critical for tenants to understand during the rental application process to avoid disputes and ensure their rights are upheld. They provide clarity and fairness in handling security deposits statewide.

How Security Deposits Relate to the Application Process

Security deposits are often requested during the rental application process in New Jersey. Landlords typically require a deposit‚ usually up to one and a half months’ rent‚ to secure the property. This amount is regulated by state law and must be stored in a separate bank account. Tenants should understand their rights regarding security deposits‚ as misuse by landlords can lead to legal consequences. The deposit process is a critical part of the application workflow‚ ensuring both parties are protected. Clear communication about deposit terms is essential to avoid disputes. Tenants are advised to review and understand deposit policies before signing a lease agreement. This step ensures transparency and mutual agreement from the start of the tenancy. Proper handling of security deposits is vital for a smooth rental experience in New Jersey.

Property Management Software and Rental Applications

Property management software streamlines rental applications in New Jersey‚ with platforms like RealPage Inc. facing scrutiny over algorithmic rent-setting practices and market competition concerns.

The Role of Software in Streamlining Applications

Software plays a crucial role in modernizing New Jersey’s rental application process‚ offering automated tools for applicant screening‚ rent setting‚ and document management. Platforms like RealPage Inc. provide landlords with efficient solutions to handle applications‚ reducing paperwork and speeding up approvals. However‚ recent legal challenges highlight concerns over algorithmic rent-setting practices‚ which may artificially inflate prices and reduce competition. Despite these controversies‚ software remains a key tool for streamlining operations‚ enabling landlords to manage multiple properties and applicants to submit materials online. The balance between technological efficiency and fair housing practices continues to shape the future of rental applications in New Jersey.

RealPage Inc. and Its Influence on Rental Practices

RealPage Inc.‚ a leading property management software provider‚ has significantly influenced rental practices in New Jersey through its algorithmic rent-setting tools. The company’s platform enables landlords to dynamically adjust rents based on market demand‚ optimizing revenue. However‚ this practice has sparked legal challenges‚ with New Jersey suing RealPage and several large landlords for alleged collusion and anti-competitive behavior. Critics argue that such algorithms inflate rents and reduce affordability‚ particularly in already competitive markets. While RealPage defends its software as a legitimate business tool‚ the lawsuit highlights growing concerns over the impact of technology on housing accessibility and fairness in the rental market.

Rental Assistance Programs in New Jersey

Rental assistance programs in New Jersey provide subsidies to low-income residents‚ with applications for waitlists opening periodically. The state also uses lottery systems for fair access.

State Rental Assistance Program Details

New Jersey’s State Rental Assistance Program provides housing subsidies to low-income residents‚ helping them afford stable housing. Applications for the program are accepted periodically‚ with a waitlist opening in January. Eligible applicants are selected through a lottery system‚ ensuring equal opportunity. This initiative aims to address the state’s housing affordability challenges by providing financial support to those in need. The program is designed to help residents pay rent and maintain housing stability‚ reflecting the state’s commitment to affordable housing solutions. It is a vital resource for many struggling to meet rising rental costs in New Jersey.

Eligibility Criteria for Assistance

To qualify for New Jersey’s rental assistance programs‚ applicants must meet specific income and household requirements. Typically‚ eligibility is based on income limits set by HUD guidelines‚ varying by household size and location. Priority is often given to low-income families‚ elderly individuals‚ and those with disabilities. Applicants must provide documentation‚ such as proof of income and residency‚ to determine eligibility. The state also considers factors like rental burden and housing instability. The lottery system for rental assistance ensures fairness‚ with selected applicants placed on a waitlist. These programs aim to support vulnerable populations in securing affordable housing amid rising rental costs across the state.

How to Apply for Rental Assistance

Applying for rental assistance in New Jersey involves a structured process. Prospective applicants must first review eligibility criteria and gather required documents‚ such as proof of income‚ residency‚ and household size. The state offers online portals where individuals can submit applications‚ with some programs requiring additional steps like lottery registration. Applications are typically reviewed on a first-come or lottery basis‚ with priority given to vulnerable populations. Once submitted‚ applicants can track their status through designated platforms. Assistance‚ if approved‚ may include subsidies to help cover rent costs. It’s essential to adhere to deadlines and provide accurate information to ensure a smooth application process and timely consideration.

Housing Affordability in New Jersey

New Jersey faces significant housing affordability challenges‚ with rising rent prices and high demand for rental assistance programs‚ impacting low- and middle-income residents statewide.

Current Challenges in Housing Affordability

New Jersey is grappling with steep rent increases‚ particularly in North Jersey counties like Hudson and Bergen‚ where housing costs strain low- and middle-income families. The state’s high demand for rental units‚ coupled with limited supply‚ has intensified affordability issues. Additionally‚ the use of algorithmic rent-setting software has drawn scrutiny‚ as it may contribute to rapid price escalations. Lawmakers are addressing these challenges through proposed legislation aimed at curbing such practices and expanding rental assistance programs. Despite these efforts‚ many residents continue to struggle with housing costs‚ highlighting the urgent need for comprehensive solutions to ensure affordable housing options statewide.

Regional Variations in Rental Prices

Rental prices in New Jersey vary significantly across regions‚ with North Jersey counties like Hudson and Bergen experiencing higher increases compared to other areas. According to recent data‚ rental prices rose by 2.31% statewide from August 2022 to August 2023‚ but this growth is uneven. Urban areas and regions near New York City tend to have higher rents due to demand and proximity to employment hubs. In contrast‚ more rural or southern counties may see slower price growth. These regional disparities highlight the complex housing market‚ where location‚ economic opportunities‚ and supply dynamics heavily influence affordability. Lawmakers are addressing these variations through targeted legislation and rental assistance programs.

The Rental Application Form: Key Components

A typical New Jersey rental application includes personal and financial information‚ rental history‚ employment verification‚ credit score‚ and background checks to evaluate tenant eligibility thoroughly.

Personal and Financial Information Required

Applicants must provide personal details such as full name‚ Social Security number‚ and contact information. Financial data includes employment history‚ income verification‚ and bank account statements. Landlords use this information to assess stability and creditworthiness‚ ensuring responsible tenant selection. Additionally‚ applicants may need to disclose previous addresses and provide references. This comprehensive approach helps landlords evaluate the likelihood of timely rent payments and proper property maintenance. By gathering detailed financial and personal data‚ landlords can make informed decisions that balance tenant qualifications with property management needs‚ fostering a mutually beneficial rental agreement. This process is crucial for maintaining tenant-landlord relationships in New Jersey’s competitive housing market.

Rental History and Employment Verification

Rental History and Employment Verification

Applicants are required to provide a detailed rental history‚ including previous addresses‚ landlords’ names‚ and tenancy durations. This helps landlords assess the applicant’s reliability and past behavior as a tenant. Employment verification is also essential‚ with applicants typically submitting proof of current and past employment‚ such as pay stubs‚ W-2 forms‚ or letters from employers. This documentation ensures the applicant has a stable income source to cover rent. Landlords may also contact employers directly to confirm employment status and salary details; Accurate and complete rental history and employment information are critical for evaluating an applicant’s suitability and financial capacity to meet rental obligations in New Jersey.

Credit Score and Background Checks

A credit score is a critical factor in New Jersey rental applications‚ with landlords typically requiring a minimum score to assess financial responsibility. A good credit score‚ often above 650‚ can significantly improve an applicant’s chances of approval. Background checks are also standard‚ reviewing criminal history‚ eviction records‚ and other public records. Landlords use this information to evaluate potential risks and ensure a tenant’s reliability. Applicants with poor credit or a problematic history may face denial or require a co-signer. These checks help landlords make informed decisions while ensuring compliance with fair housing laws‚ balancing tenant rights with property protection in New Jersey’s competitive rental market.

Processing and Approval of Rental Applications

Rental applications in New Jersey are typically processed within 3-7 business days‚ with landlords reviewing credit‚ employment‚ and rental history. Approval depends on meeting income and credit criteria‚ with some properties requiring additional screenings or co-signers. Recent legislative changes may impact how algorithms and rent-setting software influence approval decisions‚ ensuring fairness and transparency in the process.

Timeline for Application Review

In New Jersey‚ the rental application review process typically takes 3 to 7 business days‚ depending on the complexity of the application and the landlord’s screening process.

Initial reviews often occur within 24 to 48 hours‚ with landlords verifying basic information such as employment and rental history.

Credit checks and background screenings may extend the timeline by an additional 2 to 3 days‚ especially if manual verifications are required.

Applicants are generally notified of approval or denial within 7 business days‚ though some cases may take longer due to high application volumes or incomplete submissions.

Recent legislative changes‚ such as restrictions on algorithmic rent-setting software‚ aim to streamline and standardize the process‚ potentially reducing delays.

Overall‚ transparency and efficiency are increasingly emphasized in New Jersey’s rental application system.

Factors Influencing Approval or Denial

Approval or denial of a rental application in New Jersey is influenced by several key factors‚ including credit score‚ rental history‚ and income stability.

Landlords typically require a credit score of 650 or higher‚ though this can vary.

A history of evictions‚ late payments‚ or property damage can lead to denial.

employment verification and proof of income‚ often 3 times the monthly rent‚ are critical.

Criminal background checks may also play a role‚ with felony convictions potentially affecting approval.

New Jersey’s recent legislative changes aim to reduce discrimination‚ ensuring landlords use consistent criteria for all applicants.

Additionally‚ the state’s emphasis on housing affordability and rental assistance programs may influence approval processes.

Overall‚ transparency and fairness are increasingly prioritized in rental application evaluations across the state.

Special Considerations for Tenants

New Jersey offers assistance programs for low-income tenants and implements lottery systems for rental opportunities‚ ensuring equal access to housing and supporting vulnerable populations effectively always.

Low-Income Household Assistance Programs

New Jersey provides significant support for low-income households through rental assistance programs. The State Rental Assistance Program offers subsidies to help residents afford housing‚ with applications accepted for waitlists. A lottery system is also in place‚ allowing eligible low-income families to compete for rental opportunities fairly. These initiatives aim to address housing affordability challenges‚ particularly in high-cost areas like North Jersey. The state’s emphasis on assisting vulnerable populations ensures that affordable housing remains accessible‚ aligning with broader efforts to combat rising rent prices and promote housing stability for all residents.

Lottery Systems for Rental Opportunities

Lottery Systems for Rental Opportunities

New Jersey has implemented a lottery system to provide equitable access to rental opportunities‚ particularly for low-income households. This system ensures fairness in allocating limited rental slots‚ with applicants entering a randomized selection process. The state began accepting applications for its rental assistance program waitlist‚ offering housing subsidies to eligible residents. Additionally‚ the lottery for the State Rental Assistance Program allows low-income families to compete for rental opportunities transparently. This approach helps address housing affordability challenges and ensures that vulnerable populations have a fair chance to secure affordable housing. The lottery system is part of broader initiatives to enhance access to stable and affordable housing across New Jersey.

Future Trends in New Jersey’s Rental Market

New Jersey’s rental market may see increased regulation on algorithmic rent-setting tools and expanded rental assistance programs‚ aiming to enhance affordability and transparency for tenants statewide.

Expected Changes in Rental Laws

New Jersey is poised to implement significant changes in rental laws‚ particularly targeting the use of algorithmic rent-setting software. A proposed bill aims to prohibit landlords from using such tools‚ which are accused of reducing competition and driving up rents unfairly. Additionally‚ there is a growing focus on expanding rental assistance programs to support low-income tenants. The state is also exploring stricter regulations on property management software companies‚ such as RealPage Inc.‚ which have been implicated in pricing collusion. These changes reflect a broader effort to address housing affordability and ensure fair practices in the rental market. Tenants can expect increased protections and transparency in rental transactions as these laws evolve.

Impact of Legislation on Landlords and Tenants

Recent and proposed legislation in New Jersey aims to balance the interests of landlords and tenants. Landlords may face stricter regulations‚ particularly regarding the use of algorithmic rent-setting software‚ which could limit their pricing strategies. Tenants‚ however‚ are expected to benefit from increased protections against unfair practices and potentially lowered rent increases. The state’s focus on housing affordability and fair competition could reshape the rental market‚ encouraging more transparent transactions. While landlords may need to adapt to new legal requirements‚ tenants could gain greater stability and access to affordable housing options. These changes highlight a shift toward equitable rental practices in New Jersey.